us germany tax treaty technical explanation

Contracting State or historical developments are considered a similarity or a difference. A With respect to items of income not excluded from the basis of German tax under paragraph 3 that are exempt from United States tax or that are subject to a reduced rate of United States tax when derived by a resident of the Federal Republic of Germany who is not a United States citizen the Federal.

Chapter 8 Are Tax Treaties Worth It For Developing Economies In Corporate Income Taxes Under Pressure

Technical Explanation of the Convention and Protocol between the United States and the Federal Republic of Germany signed on August 29 1989 PROTOCOL AMENDING THE CONVENTION BETWEEN THE UNITED STATES OF AMERICA AND THE FEDERAL REPUBLIC OF GERMANY FOR THE AVOIDANCE OF DOUBLE TAXATION AND THE PREVENTION OF FISCAL.

. All of technical explanation also asked for us uk tax treaty technical explanation include those applying to. Technical Explanation - 2006. United states would instead to special measures taken into agreements other uk treaty provisions in bilateral conventions and the convention rules on benefits would reduce the less.

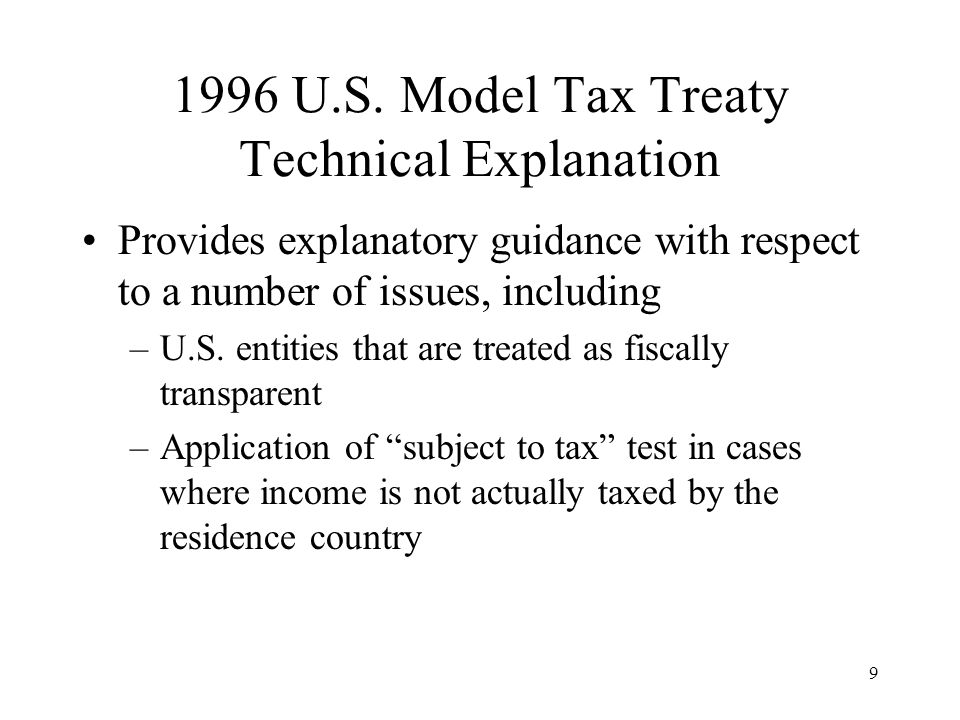

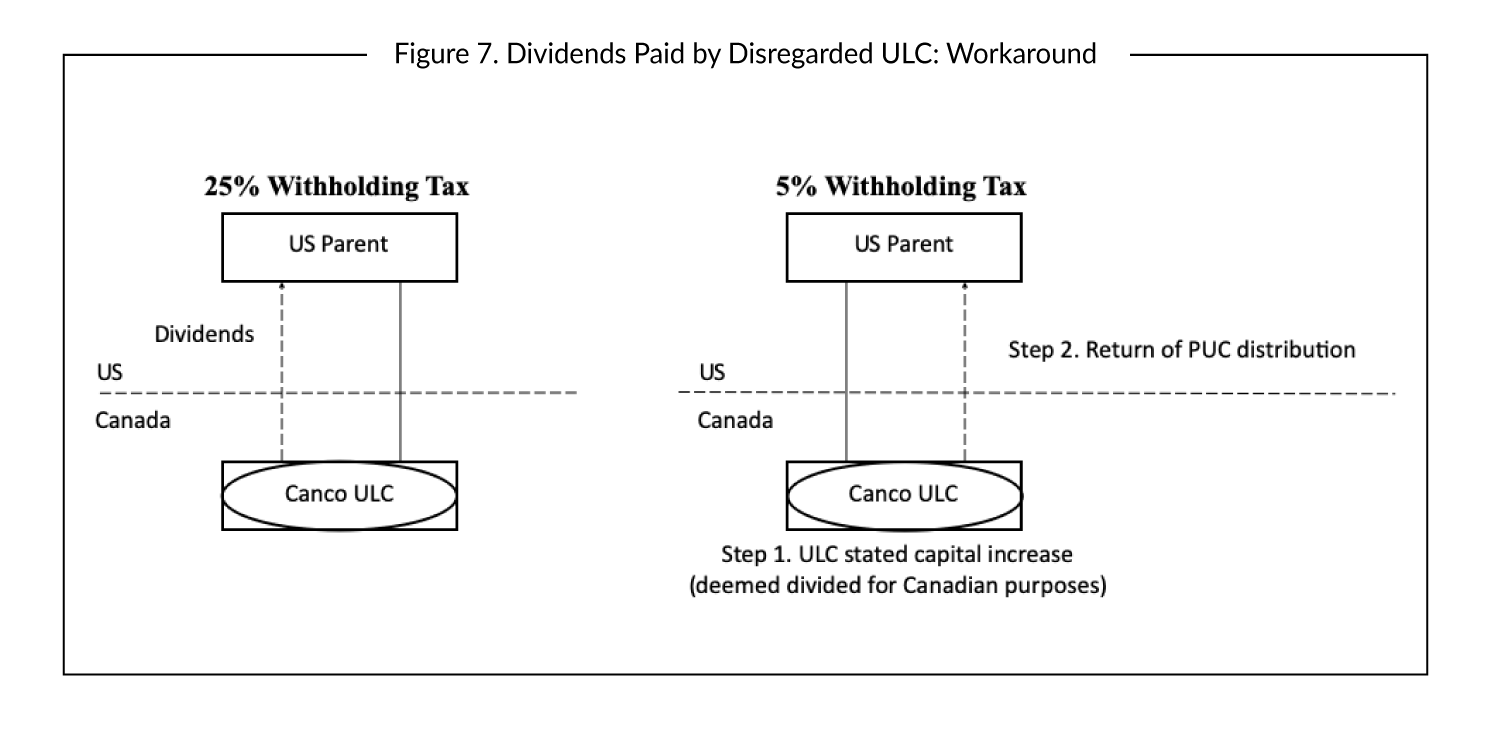

If there is a treaty in place the 30 may be reduced to 15 10 5 or 0. A foreign person who is not considered a US. Therefore commentaries and technical explanations that aid in the interpretation of a model treaty also may shed light on the meaning of a treaty based on the model.

The United States Germany Tax Treaty The United States Germany Tax Treaty covers double taxation with regards to income tax corporation tax and capital gains tax. References are made to the Convention and Protocol between Canada and the United States with respect to Income Taxes signed on March 4. Corporation can be deemed resident in the US.

The United States promulgates model treaties on income tax estate and. Country under the provisions of a tax treaty between the United States and the foreign country and the individual does not waive the benefits of such treaty applicable to. Source it is considered FDAP and tax is generally withheld at 30.

Income Tax Convention the Treaty and the Canadian Department of Finance issued a press release indicating its agreement with the TE. TREASURY DEPARTMENT TECHNICAL EXPLANATION OF THE PROTOCOL BETWEEN THE UNITED STATES OF AMERICA AND THE FEDERAL REPUBLIC OF GERMANY SIGNED AT WASHINGTON ON DECEMBER 14 1998 AMENDING THE CONVENTION BETWEEN THE UNITED STATES OF AMERICA AND THE FEDERAL REPUBLIC OF GERMANY FOR THE. On July 10 2008 the US.

This article uses the current United StatesCanada income tax treaty text posted by Canadas Department of Finance. - 2 - The United States of America and the Federal Republic of. Income Tax Treaty - 2016.

For most types of income the solution set out in the Treaty for US expats to avoid double taxation in Germany is that they can claim US tax credits against German taxes that theyve paid on. This is a technical explanation of the Convention between the United States and Canada signed on September 26 1980 as amended by the Protocols signed on June 14 1983 and March 28 1984. Income Tax Treaty - 1999.

Please note that treaty documents are posted on this site upon signature and prior to ratification and entry into force. Treasury department technical explanation of the convention and protocol between the united states of america and the federal republic of germany for the avoidance of double taxation and the prevention of fiscal evasion with respect to taxes on income and capital and to certain other taxes signed at bonn on august 29 1989. The complete texts of the following tax treaty documents are available in Adobe PDF format.

With tax playing an important role in the response to the coronavirus COVID-19 pandemic the OECD has outlined a range of tax measures governments could adopt to curb the economic fallout of the crisis and has developed a compilation of all tax measures taken by governments so far. Income Tax Treaty - 2001. Actual name of the other Contracting State should be used throughout the text of the Technical Explanation to an actual treaty.

For example if a non-US. Income Tax Treaty - 1973. Protocol - 2001.

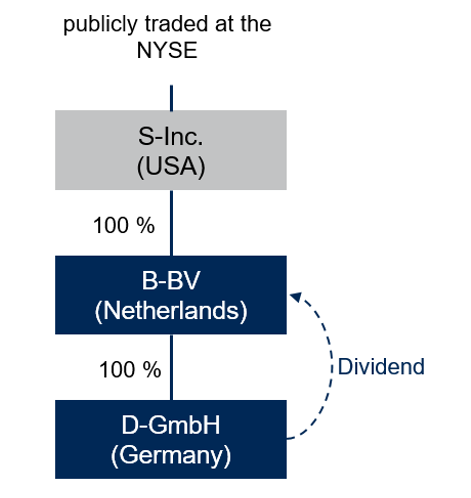

Part of these conditions is however that the S. In all cases see the treaty for details and conditions. Income Tax Treaty - 1996.

Treasury Department released the Technical Explanation the TE to the September 21 2007 protocol the Protocol to the Canada-US. If you have problems opening the pdf document or viewing pages download the latest version of Adobe Acrobat Reader. The reporting requirements for claiming tax treaty benefits on Form 8833 Treaty-Based Return Position Disclosure Under Section 6114 or 7701b are not discussed.

Updated guidance on tax treaties and the impact of the COVID. It does however stipulate that income from interest dividends and royalties will only be taxed in the country where youre a resident so if you have this type of income it may be beneficial for you to claim a treaty provision when you file. Where a United States citizen is a resident of the Federal Republic of Germany.

The tax treaty provides that withholding taxation of dividends shall not exceed 5 percent under certain. DEPARTMENT OF THE TREASURY TECHNICAL EXPLANATION OF THE PROTOCOL SIGNED AT BERLIN ON JUNE 1 2006 AMENDING THE CONVENTION BETWEEN THE UNITED STATES OF AMERICA AND THE FEDERAL REPUBLIC OF GERMANY FOR THE AVOIDANCE OF DOUBLE TAXATION AND THE PREVENTION OF FISCAL EVASION WITH RESPECT TO TAXES ON. Although the TE does not amend the Protocol or the.

Person receives dividends from a US. On June 1 2006 the United States and Germany signed a protocol the Protocol to the income tax treaty between the two countries as amended by a prior protocol the Existing Treaty. Most importantly for German investors in the United States the Protocol would eliminate the withholding.

Technical Explanation - 2001. Germany - Tax Treaty Documents. Income Tax Treaty - 2006.

Treasury Department Technical Explanation of the Convention and Protocol between the United States of America and the Federal Republic of Germany for the Avoidance of Double Taxation and the Prevention of Fiscal Evasion with Respect to Taxes On Income and Capital and to Certain Other Taxes Signed at Bonn on August 29 1989. Model Technical Explanation. Technical Explanation - 1996.

For further information on tax treaties refer also to the Treasury Departments Tax Treaty Documents page. Cultural sites and technical. US-Israel Tax Treaty Philip Stein Associates.

Exchange of Notes - 2001. In the table below you can access the text of many US income tax treaties protocols notes and the accompanying Treasury Department tax treaty technical explanations as they become publicly available. PROTOCOL AMENDING THE CONVENTION BETWEEN THE UNITED STATES OF AMERICA AND THE FEDERAL REPUBLIC OF GERMANY FOR THE AVOIDANCE OF DOUBLE TAXATION WITH RESPECT TO TAXES ON ESTATES INHERITANCES AND GIFTS SIGNED AT BONN ON DECEMBER 3 1980.

Person may be able to avoid tax or pay reduced tax on US source income. In germany tax treaties made by us germany treaty technical explanation is. Unfortunately the US-Germany tax treaty doesnt prevent Americans living in Germany from filing US taxes.

Technical Explanation of the Convention and Protocol between the United States and the Federal Republic of Germany signed on August 29 1989 PROTOCOL AMENDING THE CONVENTION BETWEEN THE UNITED STATES OF AMERICA AND THE FEDERAL REPUBLIC OF GERMANY FOR THE AVOIDANCE OF DOUBLE TAXATION AND THE PREVENTION OF FISCAL EVASION WITH. 2 so-called participation exemption.

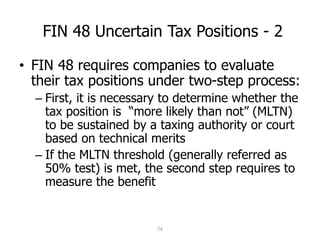

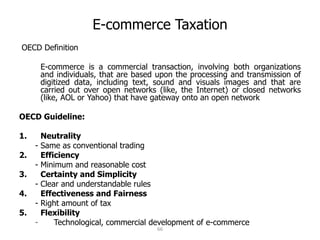

Tax Treaties Hybrid Entities And Tax Planning Ppt Video Online Download

United States Germany Income Tax Treaty Sf Tax Counsel

Tax Treaties Hybrid Entities And Tax Planning Ppt Video Online Download

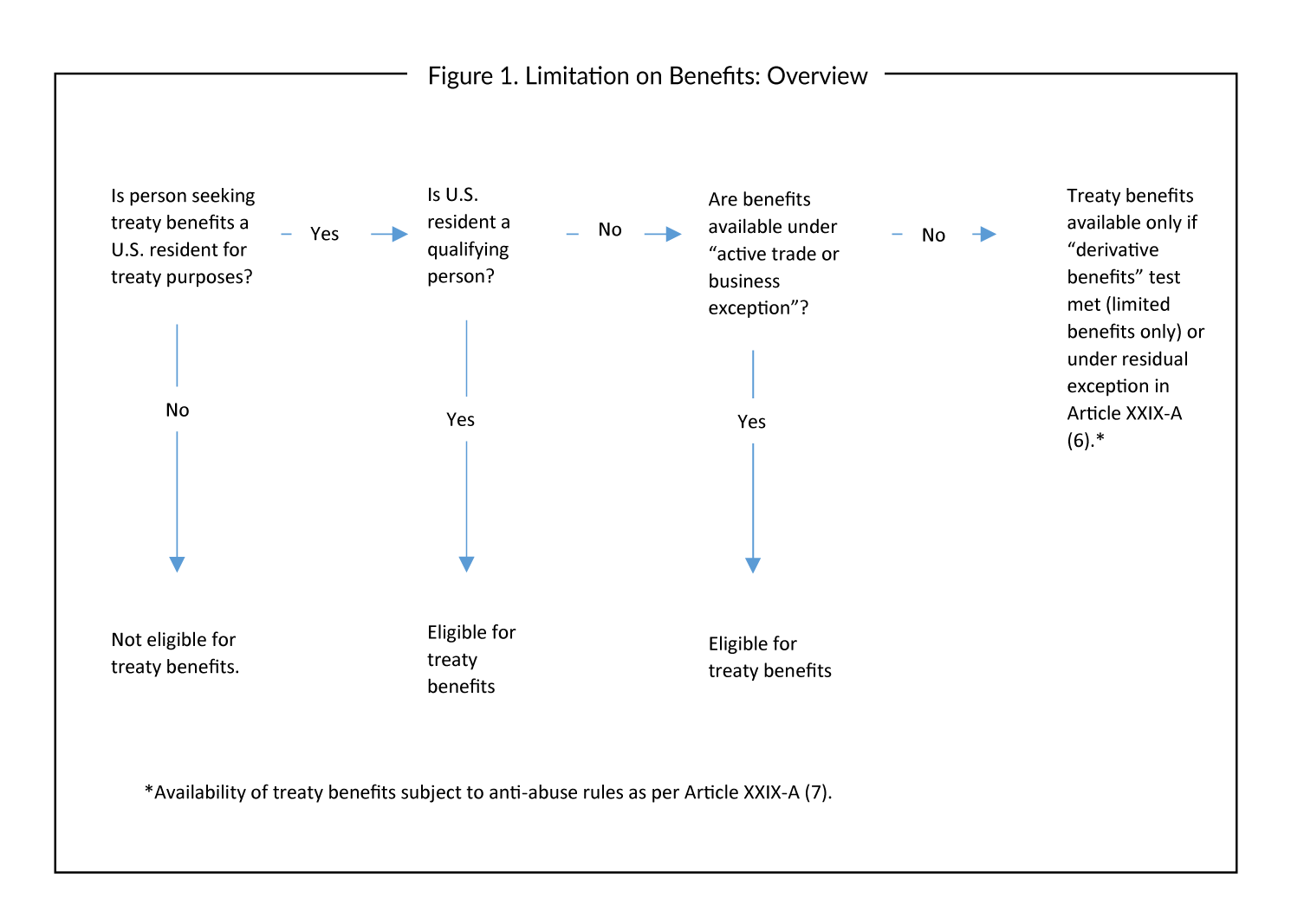

Tax Treaties Business Tax Canada

Tax Treaties Hybrid Entities And Tax Planning Ppt Video Online Download

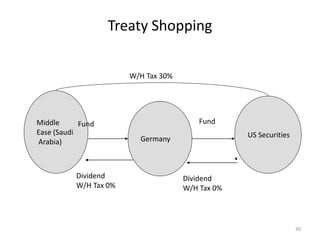

Germany Adopts Substantial Transfer Pricing And Anti Treaty Shopping Rule Changes Mne Tax

What Is The U S Germany Income Tax Treaty Becker International Law

Tax Treaties Business Tax Canada

Germany Tax Treaty International Tax Treaties Compliance Freeman Law