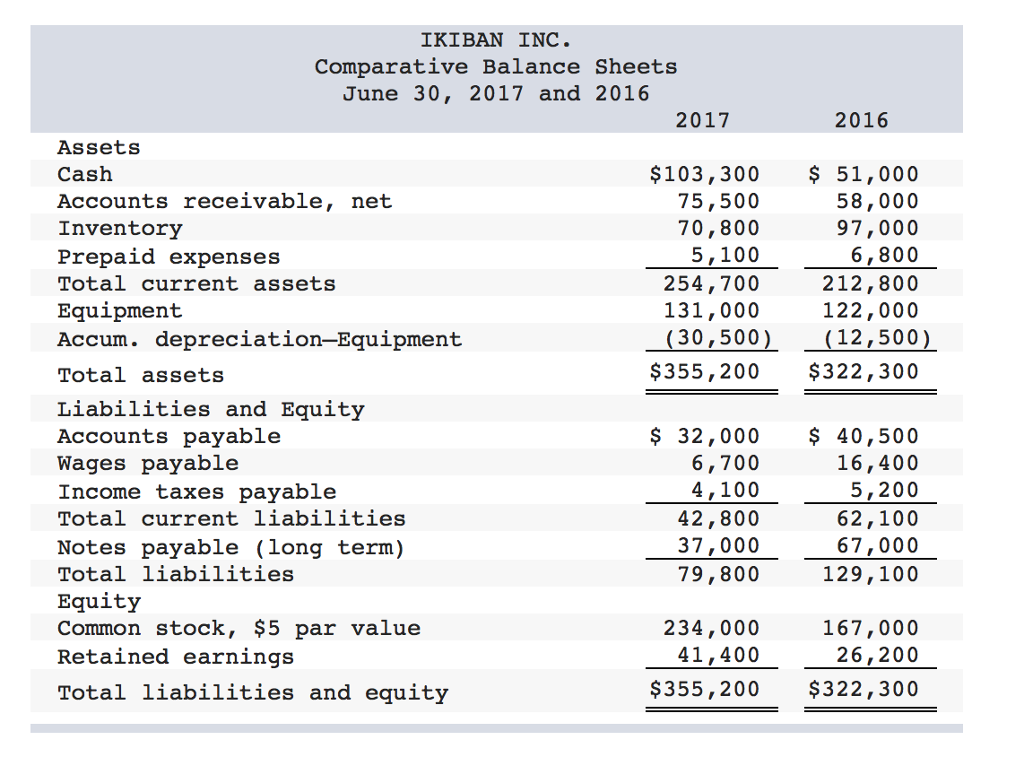

cash flow from assets formula

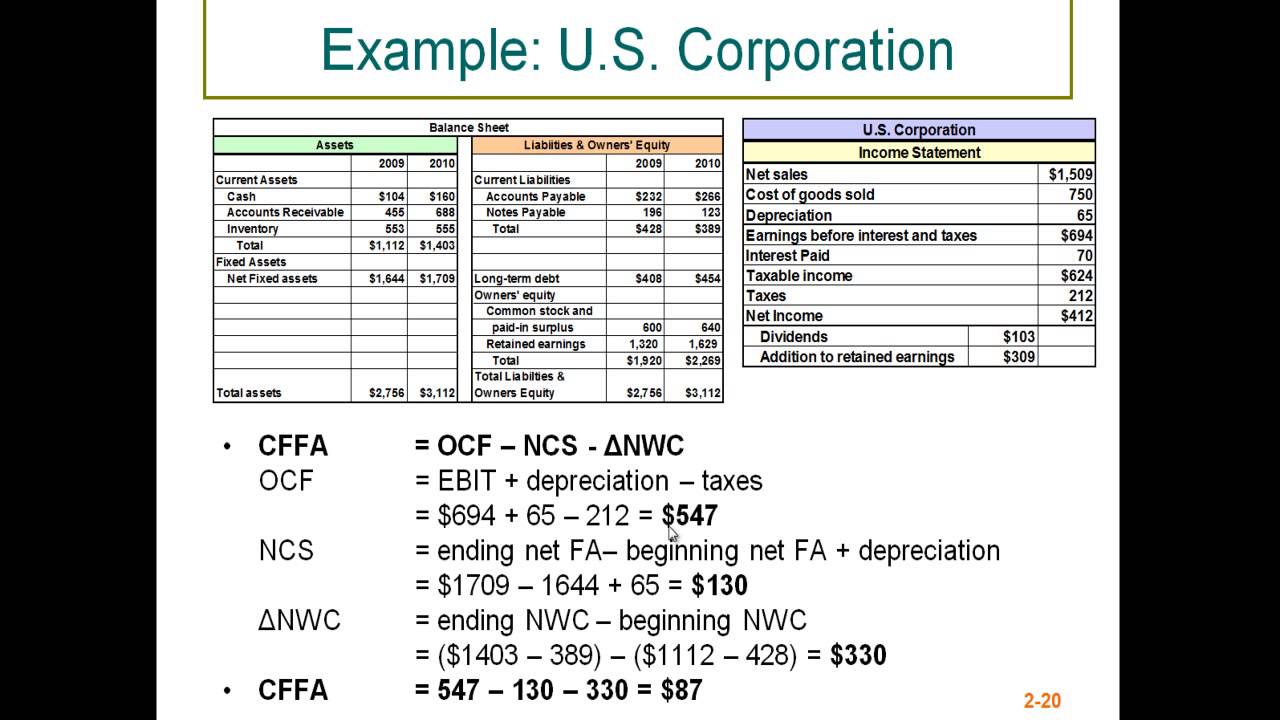

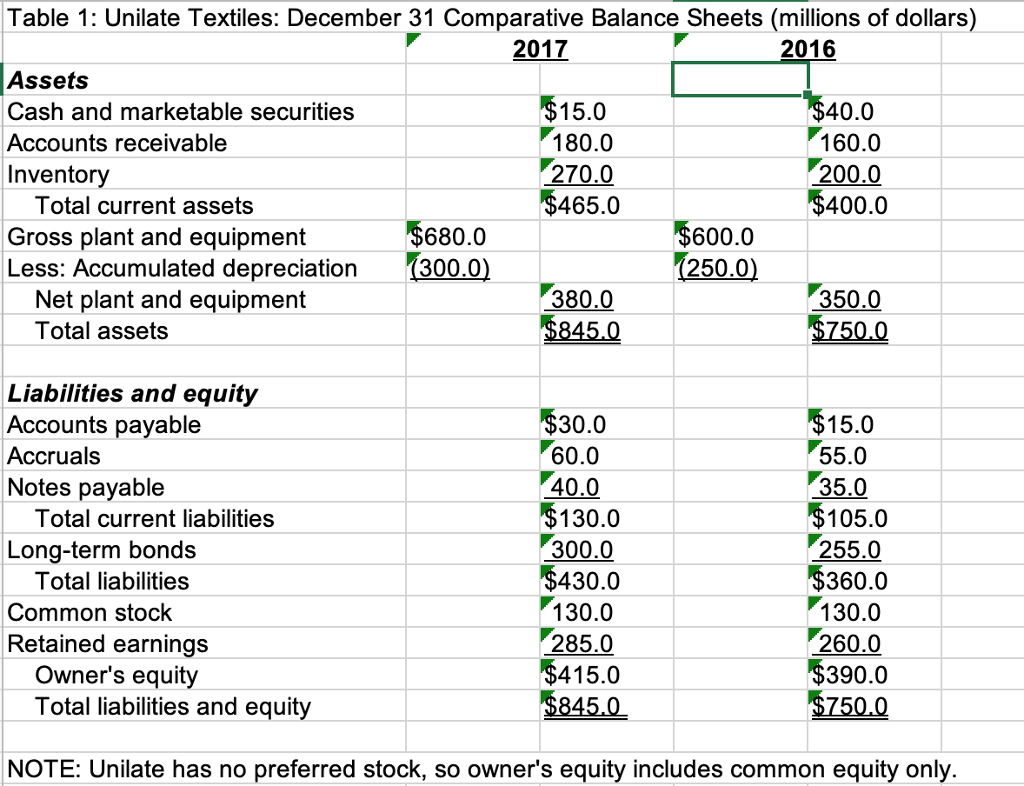

Calculate future. The second equation is what we will refer to as the Cash Flow Identity.

Solved 2 Compute The Company S Cash Flow On Total Assets Chegg Com

This results in the following cash flow from assets calculation.

. Operating Cash Flow Net Income Changes in Assets Liabilities Non-cash Expenses Increase in Working Capital Operating Cash Flow 50 million 2 million 95 million 30 million Operating Cash Flow 585 million. Therefore the company generated operating cash flow and free cash flow of 221 million and 93 million respectively during the year 2018. Cash Flow from Assets SHOULD BE Cash Flow to Stockholders Cash flow to Creditors.

The generic Free Cash Flow FCF Formula is equal to Cash from Operations Cash Flow from Operations Cash flow from operations is the section of a companys cash flow statement that represents the amount of cash a company generates or consumes from minus Capital Expenditures Capital Expenditures Capital expenditures refer to funds that are used by a. A cash flow statement is a financial statement that summarises all of a businesss cash inflows including those from ongoing operations and outside investments. Cash flow from assets Operating cash flowNet capital spendingChanges in net working capital NWC a.

As an investor or analyst it is critical to understand how each transaction contributes to a companys long-term financial. Profit for the period. Required Investments in Operating Capital Year One Total Net Operating.

This is a positive cash flow. Free Cash Flow Net Income Depreciation Change in Working Capital Capex. Cash flows from operating activities.

Once they have these three numbers Johnson Paper Company can calculate their cash flow from assets. Free Cash Flow Net income DepreciationAmortization Change in Working Capital Capital Expenditure. Cash flow from Investments formula Cash inflow from Sale of Land Cash outflow from PPE 30000 50000 -20000.

Calculate stock value based on the value of future dividend cash. 24000 -10000 2000 16000. This ratio indicates the cash a company can generate in relation to its size.

The cash flow statement includes expenditures on corporate activity and investments. Free Cash Flow Sales Revenue Operating Costs Taxes Required Investments in Operating Capital where. Cash Flow on Total Assets Ratio Formula.

Operating Cash Flow Operating Income Depreciation Taxes Change in Working Capital. Add the three amounts to determine the cash flow from assets. 12000 Cash flow generated by operations 10000 earnings 2000 depreciation -25000 Change in working capital 15000 payables - 30000 receivables - 10000 inventory -10000 Fixed assets -10000 fixed asset purchases -23000 Cash flow from assets.

Cash flow from operations. Increase in inventories c Increase in trade payables d x. Assets Liability Equity then.

Such non-current assets are not purchased frequently neither these are readily convertible into cash. OCF EBIT Depreciation Taxes OCF 139833 68220 40499 OCF 167554. Adjustments for income and expenses not involving cash flows.

Operating cash flow Earnings. Is the net cash flow from operating activities in the statement of cash flow. Cash Flow Forecast Beginning Cash Projected Inflows Projected Outflows Ending Cash.

Operating Cash Flow Net income Depreciation and amortization Stock-based compensation Other operating expenses and income Deferred income taxes Increase in inventory Increase in accounts receivable Increase in accounts payable Increase in accrued expense Increase in unearned revenue. View formula sheetdocx from FNCE 601 at University of Calgary. To construct the cash flow identity we will begin cash flow from assets.

Value assets. Equation for calculate cash flow from assets is Cash Flow From Assets f - n - w Where f Operating cash flow n Net capitalspending w Changes in net working capital. Depreciation of property plant and equipment a Profit from discontinued operations b Changes in assets and liabilities.

Cash Flow From Assets f - n - w Where f Operating cash flow n Net capitalspending w Changes in net working capital. Cash flow from assets OCF Change in NWC Net capital spending So the operating cash flow is. What is the cash flow from assets of this firm based on CFFA method 2 CFFA Method 2 CFCR CFSH CFCR interest paid net new borrowing o CFCR 44679 11412 35001 - 1119823 999244 -29587 CFSH dividends paid net new equity.

Free Cash Flow 227 million 32 million 65 million 101 million. Cash flow from assets is. The detailed operating cash flow formula is.

Cash Flow to Assets Cash from Operations Total Assets. C a s h F l o w o n T o t a l A s s e t s C a s h F l o w f r o m O p e r a t i o n s A v e r a g e T o t a l A s s e t s. Cash Flow From Assets.

Calculate APR and EAR given cash flows from annuity in Excel. Johnson Paper Companys cash flow from assets for the previous year is 16000. Read more PPE 120000 170000 -50000.

Tap card to see definition. Click card to see definition. Value assets with discounted cash flow analysis in Microsoft Excel.

However cash flow to stockholders would be replaced by cash flow to the owner in case it is a private business. Cash Flow to Creditors Cash Flow to Stockholders Click again to see term.

Fcf Formula Formula For Free Cash Flow Examples And Guide

Cash Flow Ratio Analysis Double Entry Bookkeeping

Solved Calculate The Cash Flow From Assets Cash Flow To Chegg Com

Solved 2 Compute The Company S Cash Flow On Total Assets Chegg Com

Cash Flow From Operations Ratio Formula Examples

:max_bytes(150000):strip_icc()/dotdash_Final_Cash_Flow_Statement_Analyzing_Cash_Flow_From_Investing_Activities_Jul_2020-02-c8ba3f8b48bc4dc3a460cd7ab6b6c9bd.jpg)

Cash Flow Statement Analyzing Cash Flow From Investing Activities

Disposal Of Assets Disposal Of Assets Accountingcoach

Cash Flow Formula How To Calculate Cash Flow With Examples

Financial Statements Taxes And Cash Flow Ppt Video Online Download

Operating Cash Flow Formula Calculation With Examples

Cash Flow Formula How To Calculate Cash Flow With Examples

/dotdash_Final_Cash_Flow_Statement_Analyzing_Cash_Flow_From_Investing_Activities_Jul_2020-01-5297a0ec347e4dd8996f307b3d9d61ad.jpg)

Cash Flow Statement Analyzing Cash Flow From Investing Activities